It’s not the most sexy topic in the world, but boy is it important! Many dream of the day when they can finally feel the handcuffs of debt and financial burden fall from their wrists, yet most continually forego the first and most important building block on the road towards financial freedom, your CREDIT SCORE. There are numerous actions one can take to improve their score quickly, and I’ll talk about that further down. But first, I really want you to understand why your credit score is so important.

Imagine that there are two people who would like to purchase a new car (vehicles are the worst asset to own because they burn cash in many forms and continually depreciate in value. If you can avoid a car loan and can purchase a low-cost vehicle while you build your credit, that is highly recommended). One person has a credit score of 450 and the other has a credit score of 750. Each are looking at a car which costs $30,000 and need a bank loan to complete the purchase. 750 is a good credit score and this person will likely receive a 60 month car loan at a 4.5% interest rate. The total cost for the person with a 750 score will total $35,650 after the 60 month period. Now, let’s focus on the person with the bad credit score of 450. This person is higher risk, so the bank will want to charge a higher interest rate of around 10% or greater. That means that the same $30,000 vehicle will cost this person $40,344 after the 60 month period. That is a difference of $4,694 or $78 per month! If that doesn’t sound like a lot of money to you then let me tell you this…

If you had an extra $4,694 to put into Amazon stock the day the company went public in 1997, today your $4,694 would be worth $817,694.80. Now do you understand why having good credit is so important? The wealthy understand this, and that is why they worked hard to build good credit, allowing them to put any extra cash they have into APPRECIATING ASSETS, not the opposite, such as cars.

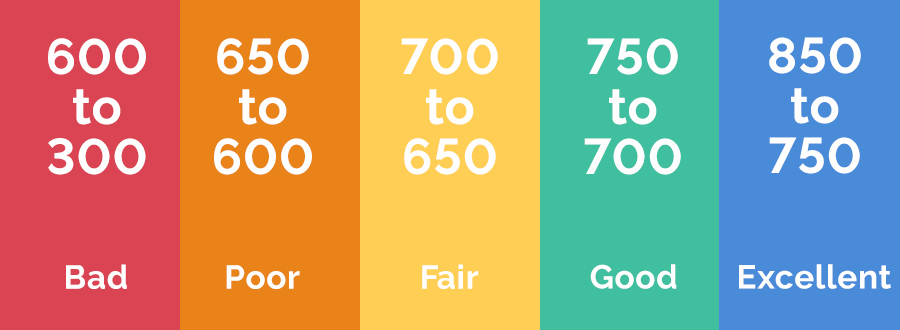

That’s all fine and dandy but you may be asking, well what can I do to improve my credit score? Well first, let’s start with understanding what your credit score is. Credit scores range between 300 to 850, with 300 being the worst and 850 being perfect. You can request a free copy of your credit report from each of three major credit reporting agencies – Equifax®, Experian®, and TransUnion®. You can also access it once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. It is important to remember that checking your credit report yourself (referred to as a soft inquiry) will not lower your credit score. However, if you apply for a new credit card or loan, the bank will need to access your credit report (known as a hard inquiry) which will lower you credit score by 5 to 20 points and will remain on your credit report for two years.

The most important factors in improving your credit score are:

- Obtain a copy of your credit report

- Dispute any credit report errors You have the right to an accurate credit report. This right allows you to dispute any credit reports by writing to the credit bureau or the creditor who listed the account on your credit report.

- Avoid high balances on any credit cards

- First, if you don’t have a credit card then you need to have one. It is a useful tool to help build your credit. Go to your bank and ask for a credit card with a low credit allowance, such as $500. Never buy anything you can’t afford to purchase that day. And when you do make a purchase, pay it off the following day.

- Any new purchases will raise your credit card balance. DO NOT let your balance exceed 30% of your credit allowance on one or all credit cards. For example, if you have two cards with credit allowance amounts of $5,000 each, never allow the balance to go higher than $3,000 (or 30% of $10,000).

- Make payments on balances on time

- Your payment history makes up 35 percent of your total credit score. When you get behind, or miss payments, it severely hurts your credit score.

- Avoid new credit card applications

- If you’re in credit building or repair mode, don’t apply for any new credit cards. These hard inquiries will hurt your credit score. After two years remaining disciplined with your current credit card, then you can safely open a new credit card account.

- Leave accounts open

- It is a common misconception that paying off a credit card balance and then closing that account boosts your credit score. It doesn’t, and actually hurts your credit score. Think about it this way – how can you someday get to a point where you have $100,000 in credit available, but you use less than 5% of that open credit just for normal purchases? You do this by building your credit worthiness over time – which means leaving credit accounts open!

- Communicate with creditors

- If you run into a financial hardship, be open about it with your creditors. Call them and explain to them your situation. You will be surprised at how helpful most creditors are. You need to do everything you can to protect your credit score, so pick up the phone and talk to someone.

- Pay down debt

- Paying down your debt load reduces your risk in the eyes of creditors. The less debt you have, the more money you can leverage in the future.

- Use the professionals

- If you are overwhelmed with your financial burdens and don’t know where else to turn, get professional help. A wonderful resource is the National Foundation for Credit Counseling.

- Remain patient and persistent

- Remember, it takes time to build and improve your credit score. Always pay your debts on-time and study the rules of building credit. There are numerous resources online of how to do the right things to build your score as fast as possible.

Everything outlined above is the first and most important step towards financial freedom. Try not to let this overwhelm or cause you stress and treat it more like a game and have fun with it! As you become more disciplined and follow these guidelines, it will give you a great deal of pleasure as you begin to see your score improve month-to-month. Smart decisions and remaining disciplined is the most critical aspect of building your credit score. Now get to it!

With All Kinds of Love,

Michael Teso